blog

california blacks out but natural gas is a hangover cure

summer months tend to be a stress test for state utilities

Hondo Lane | August 17, 2020

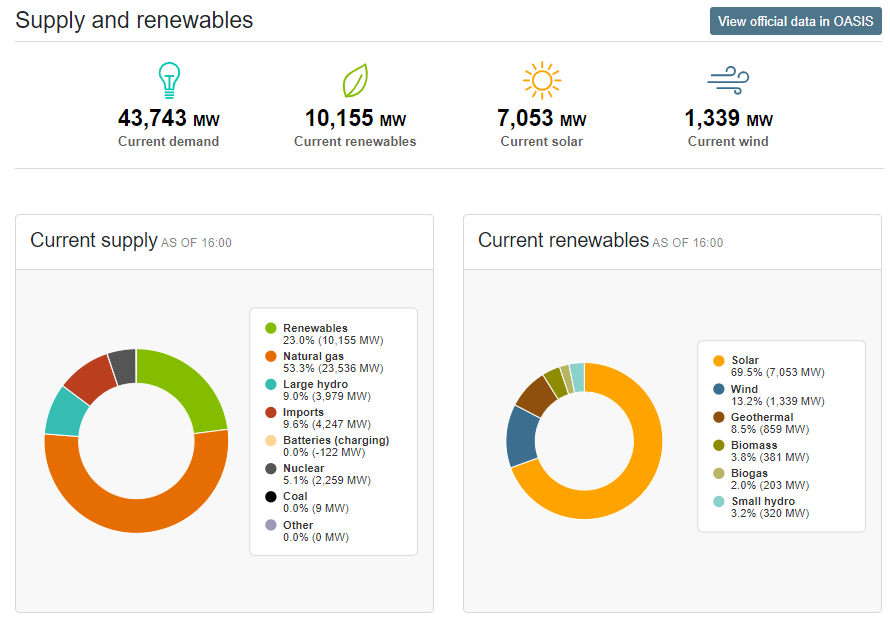

(Petrolytics) - Summer months tend to be a stress test for state utilities. More specifically, as a prolonged heat wave batters the west coast, California issues their first rolling blackout since 2001. The California Independent System Operator (California ISO), which oversees the electric power system, provides updates on capacity and forecasts peak demand throughout the day. As of Saturday evening, the demand curve is as follows:

While California's energy mix skews toward non-renewables, there's a non-trivial supply associated with wind and solar. Unfortunately, peak demand and peak renewable supply aren't totally aligned, so there exists some troublesome inefficiencies in the system. Natural gas provides the bulk of the power as a cheap, clean, and reliable energy source.

What's very promising are the ways in which households can optimize energy usage. For example, certain thermostats will kick in during peak solar supply to cool down the house. This should provide some relief on the system (but not at the scale required to avoid blackouts).

We'll keep an eye out on the grid in California. With a large number of people still working from home, the strain due to air conditioning has to be enormous. In any case, on with the update.

Oil & Gas Weekly Stats

- WTI open: $42.24/bbl

- Brent open: $44.86/bbl

- Natural gas open: $2.39/Mmbtu

- Crude oil refining +21 kbopd to 14.7 mmbopd (week of Aug 7)

- US crude oil imports -389 kbopd to 5.6 mmbopd (week of Aug 7)

- US commercial crude inventories -4.5 mmbbl to 514.1 mmbbl (week of Aug 7)

- US active oil rigs -4 to 172

- US active gas rigs +1 to 70

- Int'l active rigs at 743 (Canada at 47)

- US active frac spreads steady at 70

- Venezuela increasing exports even as production plummets

- Hess cutting 10% of workforce

Renewables Weekly Stats

- Cobalt: $15.06/lb

- Copper: $2.86/lb

- Lithium carbonate: $3.29/lb

- Nickel: $6.47/lb

- Solar photovoltaic module: $0.21/peak watt

- Uranium: $32.95/lb

- The secret to successfully closing down coal plants

- Chevron invests in nuclear fusion start-up Zap

Earnings

Very little to report in terms of earnings this week. Oxy reported results about inline with expectations. And fortunately for their employees, it appears as though salaries have been restored from the previous cut.

Oxy - Aug 10

- Net loss of $8.4 billion

- Impairment charge of $6.6 billion

- Combined production of 1,406 Mboed, exceeding guidance by +36 Mboed. Why?? Why would Oxy boast high production at record low production? Silly.

- Reduced 2020 capital spend by 50% to $2.4-$2.6B

- Shut-in production might not return to pre-curtailed levels due to well productivity damage

Other thoughts

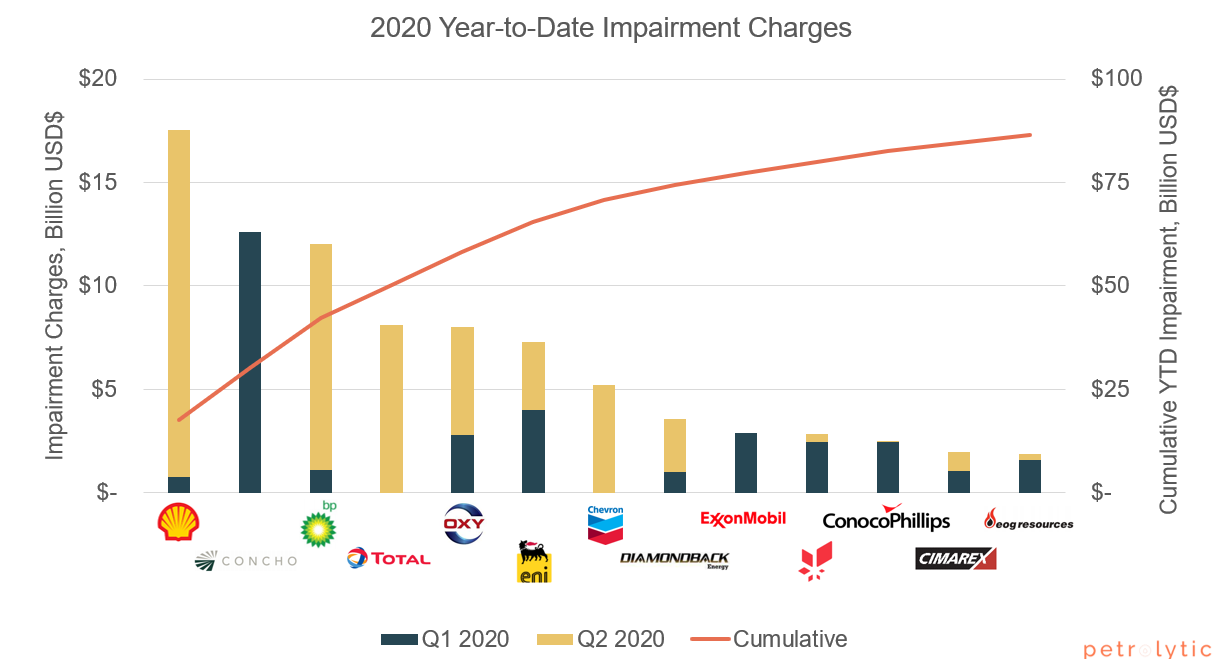

We thought we'd wrap up the oil and gas Q2 2020 earnings season with an illustration of the massive impairment charges incurred this year.

The plot above quantifies the write-downs on a per fiscal quarter and operator basis. In summary, thirteen of the top oil and gas operators have written down a cumulative $90B in 2020. While COVID and low oil prices are the typical scapegoats, we believe this is more about mismanagement of assets and difficulty in forecasting performance. Impairments aren't mean to be recovered, so this isn't drive solely by oil price (as oil price insinuates the value can be reversed if price is sufficiently high). We've written about this ad nauseam in previous posts. The below link speaks in more detail to this particular scenario.

Related: A closer look at these impairments.

Hope everyone enjoys their week. Follow us on Twitter for daily insights. We'll be back next week with another concise, but comprehensive weekly update.