blog

rig counts don't tell the whole story

and frac spreads help

Hondo Lane | July 10, 2020

(Petrolytics) - Here are the assorted links for Friday.

- Mexico's Energy Ministry + Talos - Talos is given 120 days to develop plan for carrying out JV development of the Zama field. Zama has roughly 670 Mmboe in 2C reserves

- Cloudy oil demand forecast - IEA improved global oil demand outlook but warns of resurgence of coronavirus

- Renewable Resource Adequacy Challenge - Article is very optimistic of renewables, but recognizes the challenges associated with reliability

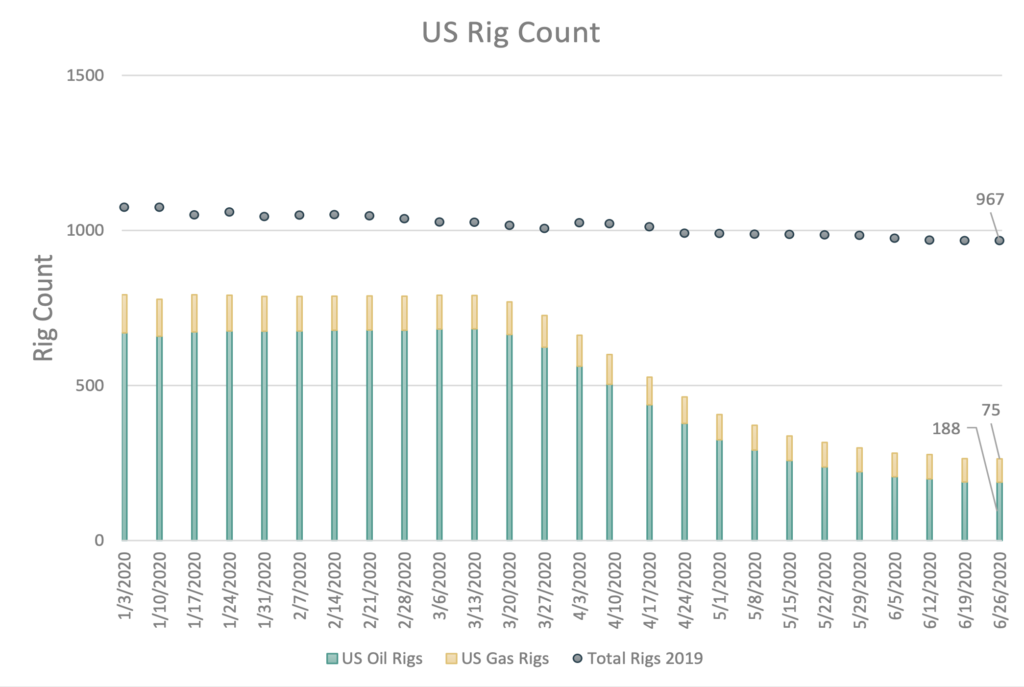

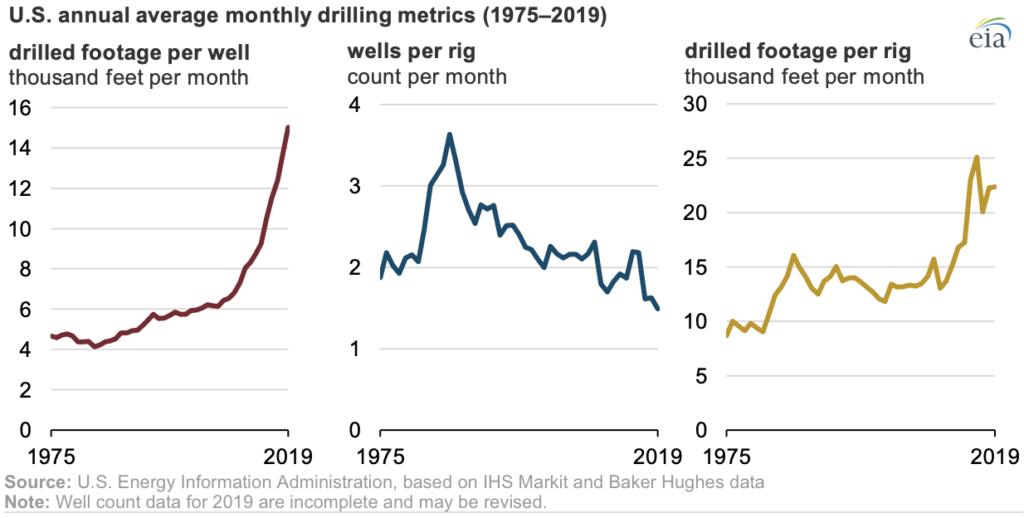

Before we break for the weekend, we need to talk about rig counts. Why is this the end-all, be-all measure of unconventional play productivity? True, it provides an indication of drilling activity, however, there's more to the story. As these rigs are outfit with additional tech and as crews mature, efficiency increases. Each rig is able to drill wells faster, deeper, and with longer laterals.

The moral of the story: rig counts are informative, however, we need to take into consideration efficiency gains. Plunging rig counts are worrisome to the oil and gas industry as whole, but don't necessarily paint the whole picture (and can make things appear much worse than reality). We need a complementary indicator - frac spreads.

While the same productivity gains are true for frac crews (i.e. each frac spread, over time, is able to complete wells quicker and with less operational issues), the trend is more indicative of near-term volumes; especially as the inventory of DUCs ebbs and flows. Furthermore, it appears as though, while active rigs have been decreasing steadily, active frac spreads hit a local minimum in May (and are substantially higher today - 45 in May vs 70 this week).

The counter-argument, however, is as rigs are stacked and frac spreads are dismantled, many of those learnings disintegrate with them. The lag time for re-learning these efficiency gains has a noticeable impact on short-term volumes.

All we're getting at here is to encourage the use of additional metrics. Frac spreads and DUC inventory are more of a leading indicator of near-term production volumes than drilling rigs (it's interesting that the TX RRC reports a decrease in issued drilling permits, but an increase in issued completion permits).

Have a great weekend everyone. Stay safe.